Some Known Factual Statements About Tulsa Ok Bankruptcy Attorney

Table of ContentsBest Bankruptcy Attorney Tulsa Fundamentals ExplainedTop Guidelines Of Chapter 7 - Bankruptcy BasicsThe Basic Principles Of Tulsa Bankruptcy Lawyer The smart Trick of Chapter 7 Vs Chapter 13 Bankruptcy That Nobody is Talking AboutThe smart Trick of Bankruptcy Law Firm Tulsa Ok That Nobody is DiscussingThe Buzz on Top Tulsa Bankruptcy Lawyers

Individuals need to make use of Phase 11 when their financial obligations go beyond Phase 13 financial obligation limitations. Tulsa OK bankruptcy attorney. Phase 12 personal bankruptcy is made for farmers and anglers. Phase 12 payment plans can be much more flexible in Phase 13.The means test takes a look at your typical monthly earnings for the six months preceding your filing date and contrasts it versus the mean revenue for a similar family in your state. If your revenue is below the state mean, you instantly pass and do not need to complete the entire kind.

If you are married, you can file for insolvency collectively with your partner or separately.

Filing personal bankruptcy can assist an individual by discarding financial debt or making a plan to settle financial obligations. An insolvency case usually begins when the debtor submits a petition with the insolvency court. A petition might be filed by a specific, by spouses together, or by a corporation or various other entity. All insolvency instances are managed in federal courts under guidelines laid out in the U.S

The Buzz on Bankruptcy Attorney Tulsa

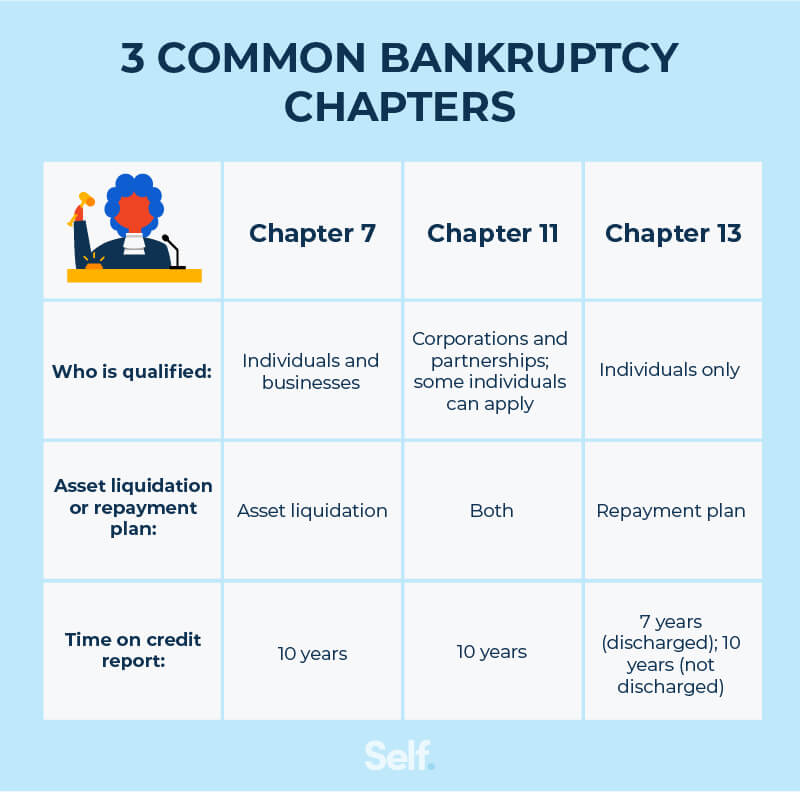

There are various types of personal bankruptcies, which are normally described by their phase in the U.S. Insolvency Code. People may submit Phase 7 or Phase 13 insolvency, relying on the specifics of their scenario. Municipalitiescities, communities, villages, straining areas, local utilities, and school areas might file under Phase 9 to reorganize.

If you are encountering monetary obstacles in your individual life or in your organization, possibilities are the concept of declaring personal bankruptcy has actually crossed your mind. If it has, it additionally makes sense that you have a lot of bankruptcy inquiries that require answers. Lots of people really can not respond to the concern "what is personal bankruptcy" in anything except general terms.

If you are encountering monetary obstacles in your individual life or in your organization, possibilities are the concept of declaring personal bankruptcy has actually crossed your mind. If it has, it additionally makes sense that you have a lot of bankruptcy inquiries that require answers. Lots of people really can not respond to the concern "what is personal bankruptcy" in anything except general terms.

The 9-Minute Rule for Affordable Bankruptcy Lawyer Tulsa

Chapter 7 is labelled the liquidation bankruptcy phase. In a phase 7 insolvency you can get rid of, erase or discharge most sorts of financial debt. Examples of unsafe debt that can be erased are bank card and clinical expenses. All kinds of people and companies-- individuals, wedded couples, companies and partnerships can all file a Chapter 7 insolvency if eligible.

Numerous Phase 7 filers do not have much in the means of properties. They may be renters and own an older automobile, or no automobile whatsoever. Some live with moms and dads, friends, or brother or sisters. Others have homes that do not have much equity or are in severe requirement of repair work.

Financial institutions are not enabled to seek or keep any type of collection tasks or claims during the case. A Chapter 13 bankruptcy is really effective due to the fact that it provides a mechanism for borrowers to stop foreclosures and sheriff sales and quit foreclosures and utility shutoffs while catching up on their safeguarded financial debt.

The Best Strategy To Use For Top-rated Bankruptcy Attorney Tulsa Ok

A Phase 13 case may be helpful because the debtor is permitted to get captured up on home mortgages or auto loan without the threat of repossession or repossession and is enabled to keep both excluded and nonexempt building. The borrower's plan is a file outlining to the bankruptcy court how the debtor recommends to pay existing expenses while paying off all the old debt equilibriums.

It gives the debtor the possibility to either sell the home or come to be captured up on home mortgage settlements that have actually dropped behind. An individual submitting a Phase 13 can recommend a 60-month plan to heal or become existing on mortgage payments. If you dropped behind on $60,000 worth of home mortgage settlements, you could recommend a plan of $1,000 a month for 60 months to bring those home mortgage payments current.

It gives the debtor the possibility to either sell the home or come to be captured up on home mortgage settlements that have actually dropped behind. An individual submitting a Phase 13 can recommend a 60-month plan to heal or become existing on mortgage payments. If you dropped behind on $60,000 worth of home mortgage settlements, you could recommend a plan of $1,000 a month for 60 months to bring those home mortgage payments current.

Things about Tulsa Ok Bankruptcy Attorney

In some cases it is much better to prevent insolvency and clear up with financial institutions out of court. New Jersey additionally has an alternative to visit the website insolvency for businesses called an Job for the Benefit of Creditors and our law practice will review this alternative if it fits as a prospective technique for your service.

We have actually developed a tool that aids you choose what phase your file is most likely to be filed under. Click right here to use ScuraSmart and figure out a possible service for your financial debt. Many individuals do not realize that there are several sorts of personal bankruptcy, such as Phase 7, Chapter 11 and Phase 13.

Below at Scura, Wigfield, Heyer, Stevens & Cammarota, LLP we deal with all types of bankruptcy cases, so we are able to address your insolvency questions and help you make the most effective decision for your case. Here is a short appearance at the financial obligation alleviation choices available:.

Little Known Questions About Bankruptcy Attorney Tulsa.

You can just declare personal bankruptcy Prior to filing for Phase 7, at the very least one of these ought to be real: You have a lot of debt revenue and/or properties a lender might take. You shed your chauffeur license after being in a crash while without insurance. You require your permit back (Tulsa OK bankruptcy attorney). You have a great deal of debt near the homestead exception quantity of in your house.

The homestead exception amount is the greater of (a) $125,000; or (b) the county median list price of a single-family Tulsa bankruptcy lawyer home in the preceding fiscal year. is the amount of cash you would certainly keep after you marketed your home and settled the mortgage and other liens. You can discover the.

Comments on “Some Known Details About Tulsa Ok Bankruptcy Attorney”